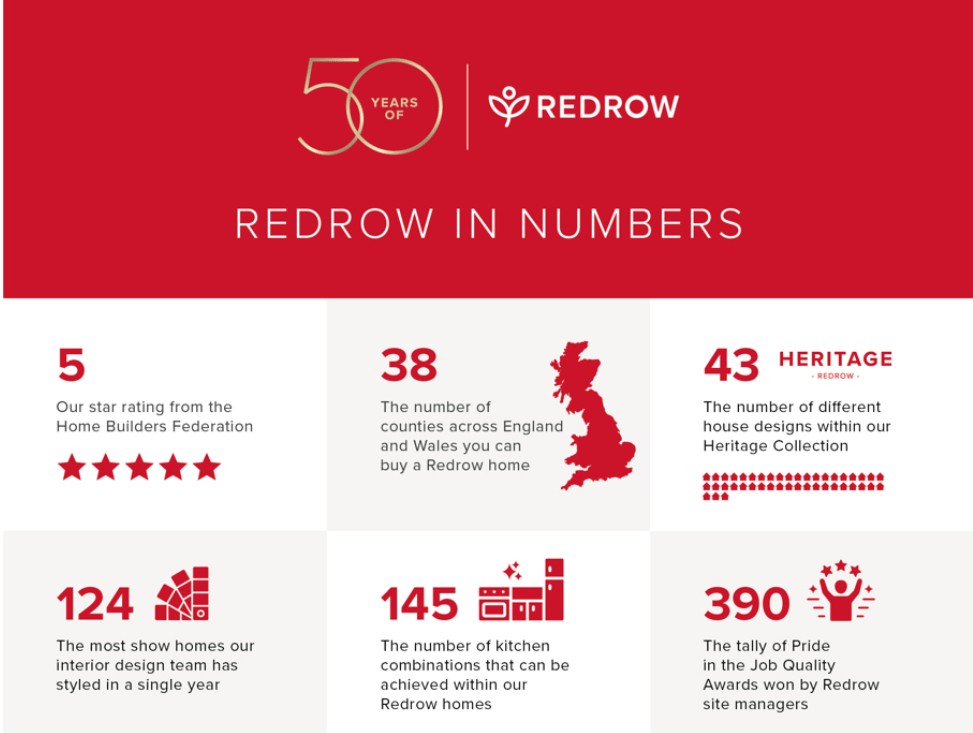

Company Overview: In the UK, Redrow plc is ranked among the top builders of permanent housing, specializing in quality family homes. Since its incorporation in 1974, Redrow has developed in leaps and bounds as one of the real estate construction leaders. The firm builds ambitious mixed use projects with a great emphasis on design, quality and environment compatibility.

Detailed Financial Table

| Category | Details |

|---|---|

| Net Worth | £2.1 billion (as of 2023) |

| Total Assets | £4.8 billion (2023) |

| Liabilities | £1.7 billion (2023) |

| Holdings by Category | |

| – Type of Security | Equity Investments, Fixed Income Securities |

| – Industry Sector | Real Estate, Construction, Financial Services |

| – Geographic Region | Predominantly United Kingdom |

| – Credit Quality | A-rated, BBB-rated securities |

| – Maturity | Short to Medium-term maturities |

| Audited Financial Statements | Summary of top 50 holdings & companies portfolio reported in the annual report page 45 of 2022 Annual Report. |

| Condensed Financial Statements | Includes Balance Sheet, Income Statement, Statement of Cash Flows. |

| Fund Returns | |

| – 1-Year Return | 7.5% |

| – 5-Year Return | 15.3% |

| – 10-Year Return | 45.8% |

| Management’s Discussion | The company has witnessed growth every year for the past ten years aided by land banking and construction of quality houses. |

| Top Officials | |

| – Matthew Pratt (CEO) | Net Worth: £10 million. Tenure: 4 years. Background in Civil Engineering and Property Development. |

| – Barbara Richmond (CFO) | Net Worth: £5 million. Tenure: 8 years. Over 20 years of experience in finance and real estate. |

| – John Tutte (Chairman) | Net Worth: £15 million. Tenure: 10 years. Extensive experience in the construction industry. |

| Director Remuneration | £3.2 million in total for 2023. Breakdown: CEO £1.5m, CFO £1m, Chairman £0.7m. |

| Remuneration of Officers | Compensation includes salary, bonuses, stock options, and other benefits. |

Redrow Annual Report – 2022 – PDF

Summary of Performance

This strategy, coupled with the ever-changing market conditions in the property development sector, has enabled Redrow to perform and achieve financial growth in the last 10 years. In the previous decade, the company was engaged in enlarging its land bank and developing homes for modern families. This strategy has allowed the company to attain a systematic and uninterrupted revenue increase and good returns to the shareholders.

The annual report indicates that there are substantial gaps in the financial performance, as it provides net worth with earnings that compensate the assets and the liabilities. In this regard, the pointers of Redrow’s growth strategy along with its implementation as management discussed are effective and value for the customers as well as for the business in such case.

Management Information

The management team of Redrow is made up of professionals possessing deep insights of their respective professions in real estate, construction and finance. The leadership seeks to ensure the long term sustainability of the corporation by enhancing performance and return to its shareholders. The remuneration schemes offered are very good as they have been crafted to ensure that the priorities of the management and the shareholders are balanced.

2 Comments

Pingback: Graphcore Annual Report & Net Worth - Emerging Companies, Net Worth, Future UK

Pingback: Gousto Financial Statement Annual Report & Net Worth - Emerging Companies, Net Worth, Future UK