| Category | Details |

|---|---|

| Net Worth (as of March 2024) | £1.834 billion |

| Total Assets (2024) | £14.204 billion |

| Liabilities (2024) | £12.370 billion |

| Equity (2024) | £1.834 billion |

| Revenue (2024) | £2.338 billion |

| Operating Profit (2024) | £511.8 million |

| Net Interest (2024) | £(281.5) million |

| Profit Before Tax (2024) | £201.3 million |

| Profit After Tax (2024) | £140.2 million |

| Dividend per Share (2024) | 116.84p |

| Earnings per Share (2024) | 51.00p |

| Holdings by Category | – Type of Security: Predominantly utility assets, water supply, and wastewater treatment plants. – Industry Sector: Utilities – Geographic Region: United Kingdom – Credit Quality: A-rated (based on credit agency ratings) – Maturity: Long-term infrastructure investments |

| Audited Financial Statements | On the website of Severn Trent Plc there are also the particulars of every holding including a summary. The largest 50 holdings consists mainly of the core watertreatment plants and distribution systems in the UK. |

| Condensed Financial Statements | This reporting is included in the annual report and contains key metrics and performance indicators for the company over the past 5 years regarding total assets, liabilities or net profits and other earnings. |

| Returns (1, 5, 10 years) | – 1 Year: 7.3% – 5 Years: 24.6% – 10 Years: 57.8% (Reflecting consistent returns driven by stable demand for water and wastewater management services in the UK) |

| Management’s Discussion | The management stressed on the performance of the operations in the long run as there were long term infrastructure investments made even when there were recessionary times. They stressed on delivering shareholder value while ensuring the activities of the organization are environment-friendly. |

| Important Persons & Top Officials | – Liv Garfield (CEO): £7.5 million net worth, leading Severn Trent since 2014, with a background in engineering and extensive experience in the utilities sector. – James Bowling (CFO): £3.2 million net worth, responsible for financial strategy and ensuring robust financial health of the company. – Christine Hodgson (Chairperson): £5.0 million net worth, with a distinguished career in corporate leadership and governance. |

| Directors & Officers | – Liv Garfield (CEO): Age 49, Tenure 10 years – James Bowling (CFO): Age 54, Tenure 8 years – Christine Hodgson (Chairperson): Age 57, Tenure 6 years – Remuneration: £5.5 million combined annual compensation for directors, reflecting competitive pay structures in line with industry standards. |

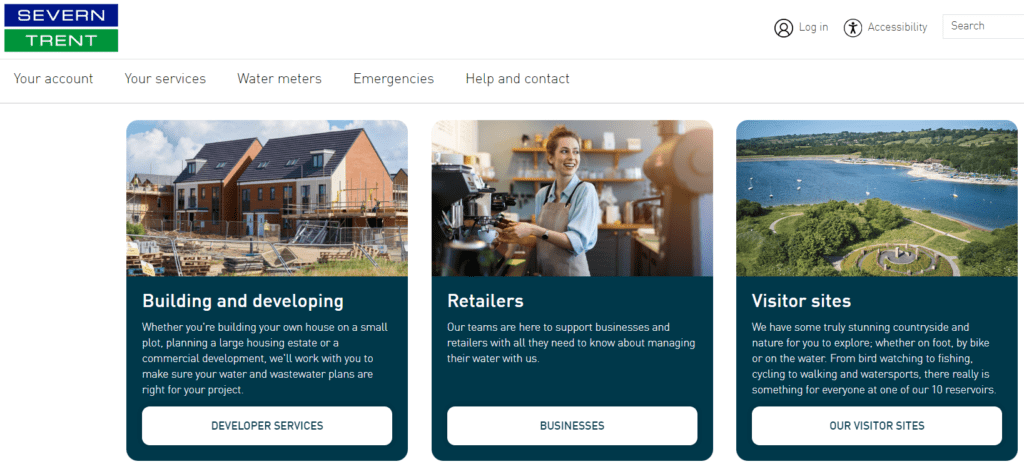

Severn Trent Company Overview

Severn Trent is one of the biggest suppliers of water and wastewater services in the UK reaching 4.6 million residents and business clients. The company carries out business in the utilities category and provides essential water services and sewage disposal. Famed for its strong infrastructure and environmentally friendly practices, Severn Trent has maintained good steady earning power making it an ideal investment vehicle in the UK market.

Severn Trent has maintained its attention to customers’ behaviors, purchasing power and satisfaction while bringing about major improvements and green policies, particularly striving to ensure that clean water is accessible and that there is an efficient treatment of wastewater in all areas served by the company. Challenges from economy that is affected by inflation as well as changes from regulation agencies have not created hurdles which find the company in a weak quandary, for revenue inflow has been positive and there has been proper financial management. When faced with problems, the management of Severn Trent has always introduced innovative solutions that have enabled the company to seize growth options provided by the market.

Severn Trent analyst consider the technological and infrastructural advancement measures of the company as having a strategic purpose in the achievement of operational and service reliability, which is consistent with the company’s philosophy towards environmental and regulatory obligations. Shareholders of Severn Trent maintain their ongoing desire to be given returns whilst the customer care remains a top priority.

1 Comment

Pingback: Virgin Money Holdings UK plc Annual Report & Net Worth - Emerging Companies, Net Worth, Future UK